Amid global economic volatility, the projected scale of USD 13.37 billion by 2033 for Vietnam’s dairy industry is not only a promising figure, but also a massive pressure on operational systems. For management teams, the key question is no longer “how to grow,” but “how to grow profitably” by tightening costs and optimizing the distribution chain.

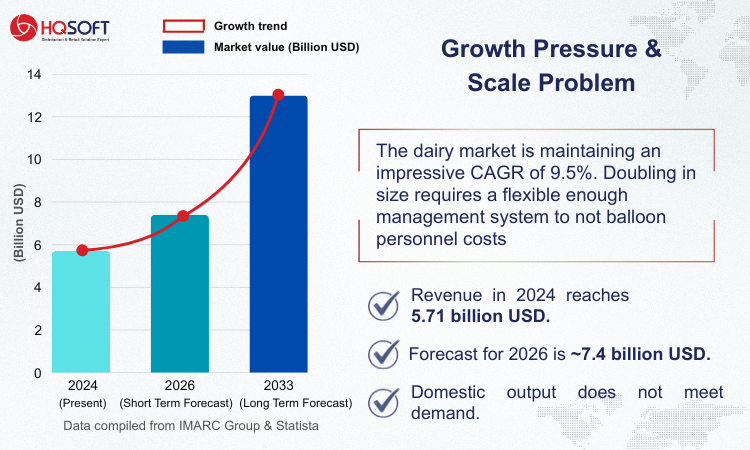

According to the latest data from IMARC Group, Vietnam’s dairy market is entering a golden growth phase. Valued at approximately USD 5.71 billion in 2024, the market is forecast to maintain an impressive compound annual growth rate (CAGR) of 9.5% during 2025–2033, officially reaching USD 13.37 billion by 2033.

Specifically for 2025, Statista estimates total revenue from the dairy and egg industry at around USD 8.59 billion, with a stable growth rate of 6.62% continuing through 2030.

However, behind these attractive revenue figures lies a complex challenge in supply chain and cash flow management. According to Tridge, although domestic milk production is expected to reach 2.53 billion kilograms by 2028, it still cannot fully satisfy domestic demand. In reality, Vietnam remains heavily dependent on imported raw materials. Evidence shows that in 2021, import volume exceeded 3,700 tons, while domestic production stood at only 1,100 tons (IMARC).

The optimistic outlook for consumption demand is undeniable. Milk consumption volume is projected to increase by approximately 4.0% in 2025, raising per-capita consumption to around 20.7 kg per year. Notably, according to Research and Markets, this figure is expected to surge from 28 liters per person in 2021 to 40 liters per person by 2030.

Strategic insight: A 40% increase in consumption demand within less than a decade means retail touchpoints, transaction frequency, and supply chain complexity will multiply. If businesses continue to rely on manual management thinking, operational bottlenecks will become the very barrier preventing them from capturing this massive growth opportunity.

To break through, managers must realign their strategies with evolving consumer behavior:

From a strategic perspective, these product lines offer higher profit margins but also require much stricter storage processes and expiration management (FEFO) compared to traditional dairy products.

Many businesses are facing a situation of “hot growth but cold profits.” The root causes often lie in the following three strategic gaps:

In a period when businesses are tightening expenditures (cost-cutting), investing in HQSOFT’s Distribution Management System (DMS) should be viewed as a strategic investment, not an expense.

Our solution ecosystem focuses on four core values to help dairy businesses optimize profit margins:

Vietnam’s dairy market in 2026 holds immense potential, but only businesses that leverage technology to control operating costs will be able to sustain their competitive advantage. As profit margins continue to be squeezed by tax pressures and rising input costs, digitalization is the only path for enterprises to protect their growth achievements.

Are you ready to optimize operational costs for your dairy business?

[CONTACT HQSOFT EXPERTS NOW TO RECEIVE STRATEGIC CONSULTATION]

bài viết liên quan

Bài viết nổi bật